CIBC: Client Account Switch

Role: UX and Visual Design / Duration: 3 week sprint

The Problem

There are many incentives to change banks, typically an attractive product offering, lower fees or superior service. Today at CIBC, switching banks can be facilitated in some capacity by an advisor in branch, but alot of work is required of the client to do on their own time and it can be difficult determine if you’ve done enough to setup your new account. We partnered with the deposits team to explore ways to provide primary bank switchers with a toolkit that enables them to switch their savings over to CIBC in a methodical and guided way.

Hill Statement

As a new CIBC chequing account client, I want to transfer my Direct Deposits (DDs), Pre-Authorized Debits (PADs), existing funds and other recurring payments/payees to my CIBC account through a centralized digital experience that updates me on the status of the transactions that I choose to switch.

Research Sources

Results from research conducted by CIBC on “bank switchers”

AlphaUX survey delivered to over 400 recent Canadian bank switchers

8 Frontline CIBC employees interviewed

5 interviews with Simplii mortgage advisors

6 external market reports

Persona

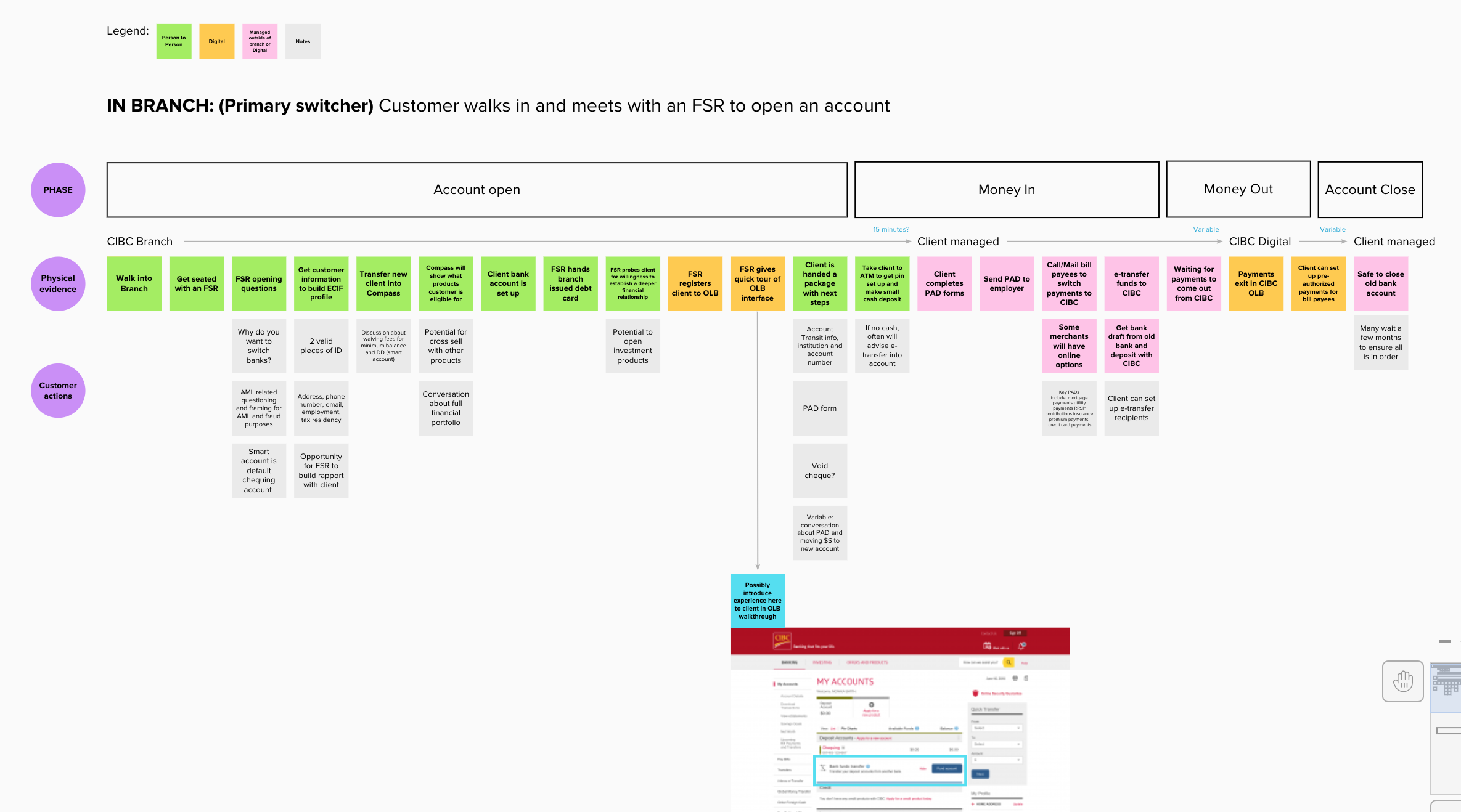

Phased approach

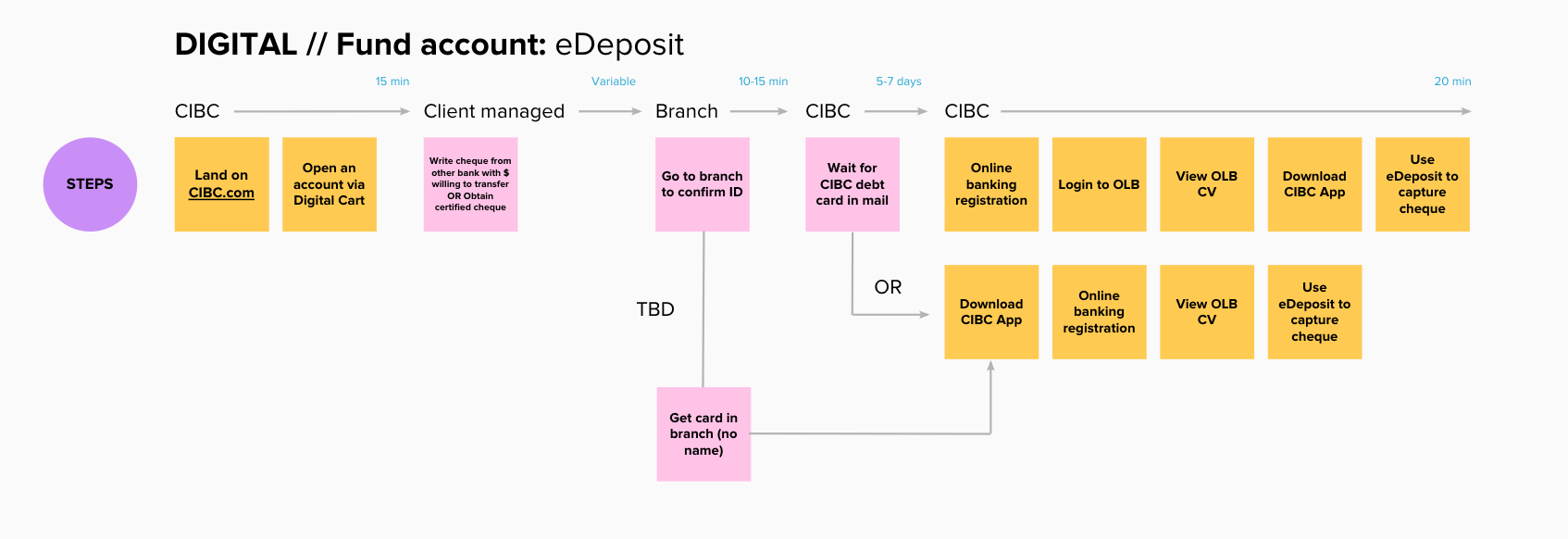

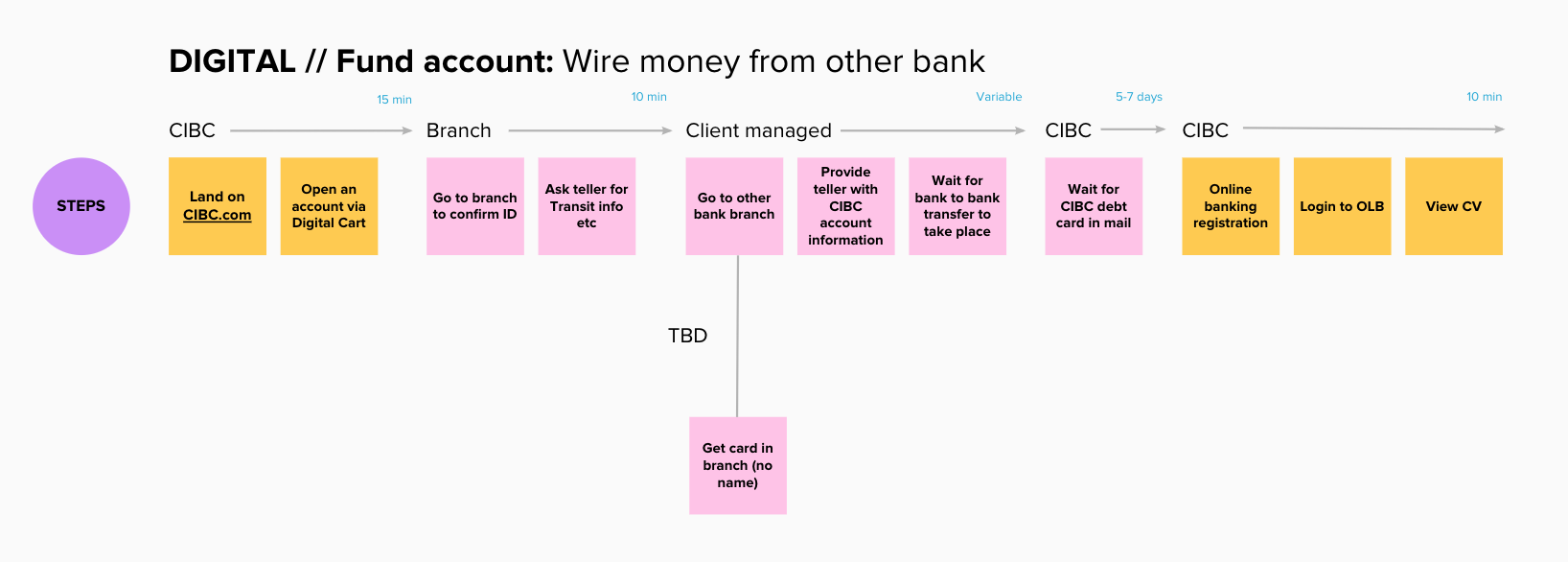

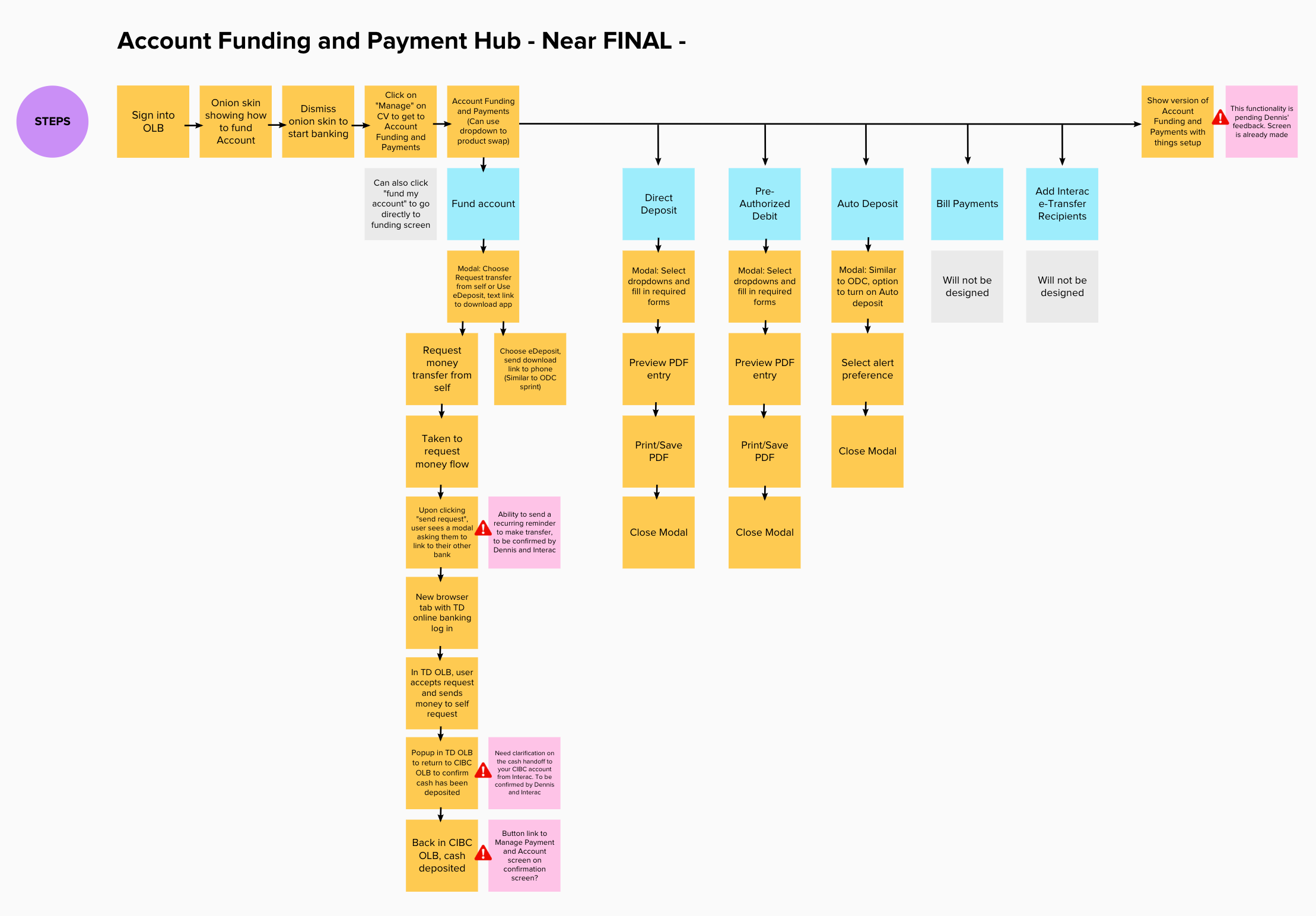

Among the features explored during workshop ideation was a more robust digital means of transferring money digitally outside of the amount limits of an e-transfer. This was descoped from our project but it was decided that it would be revisited in a future sprint. This required me to focus on building a scalable solution that could easily integrate features to come down the road to enable the hub to be more robust and provide additional convenience to our users.

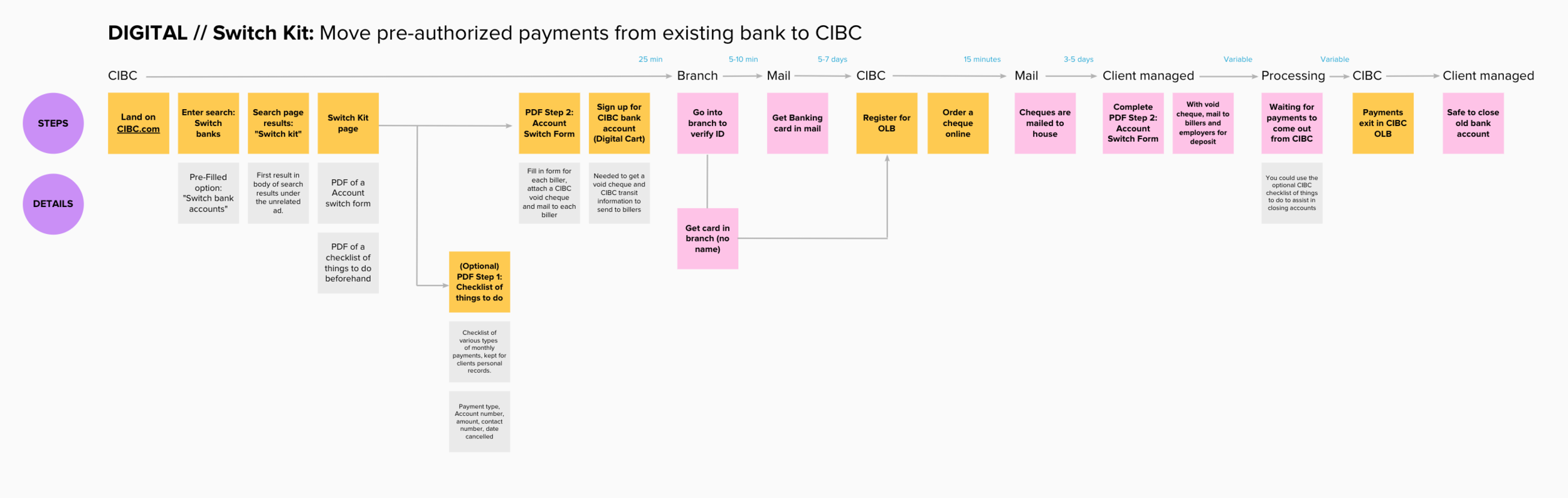

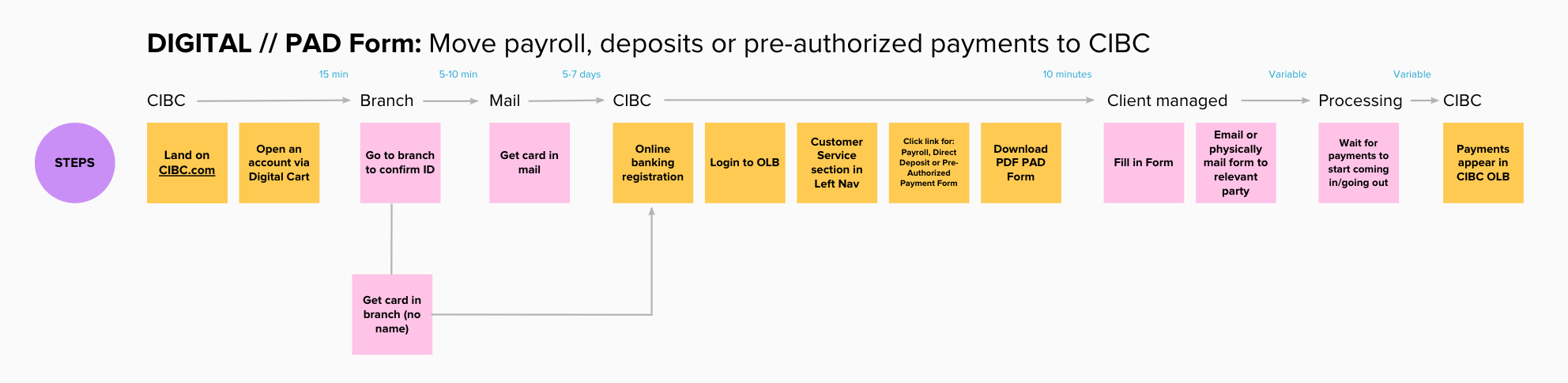

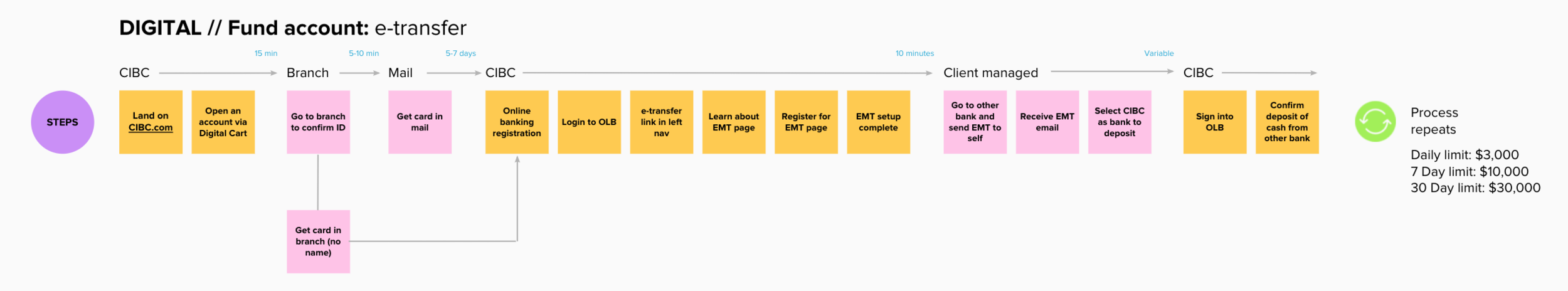

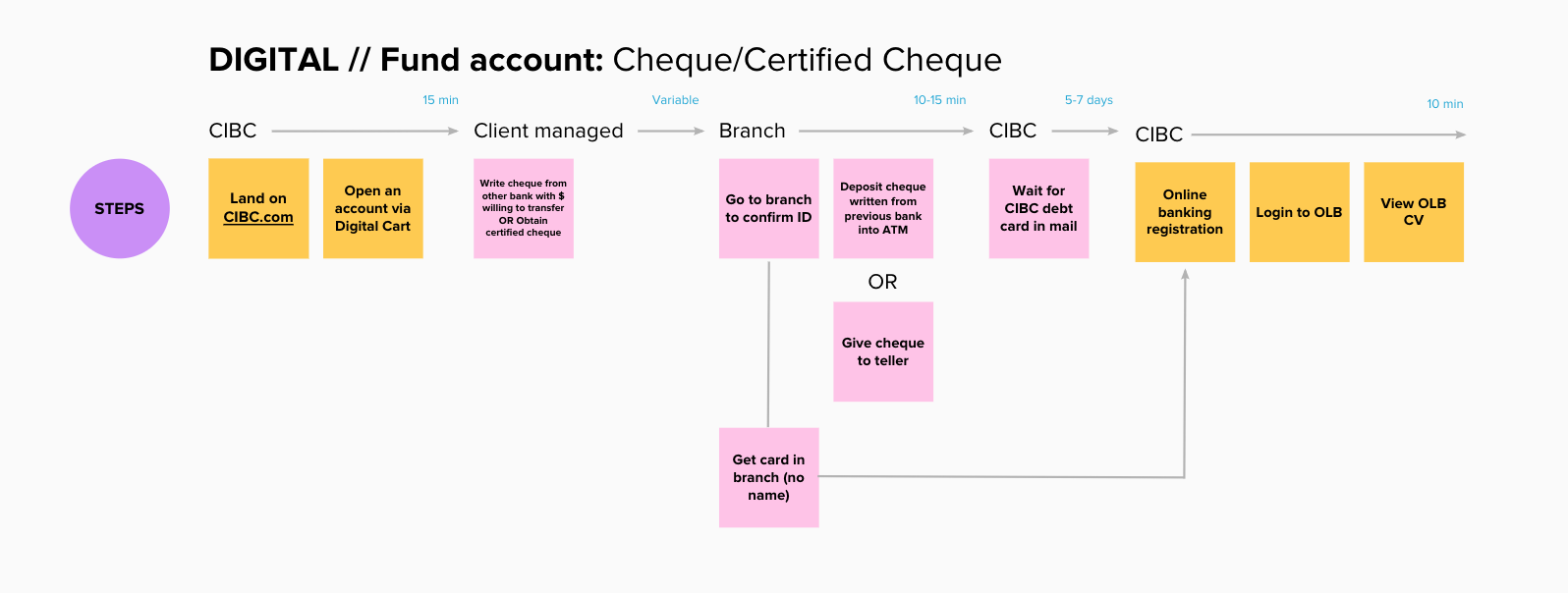

High Level Flows

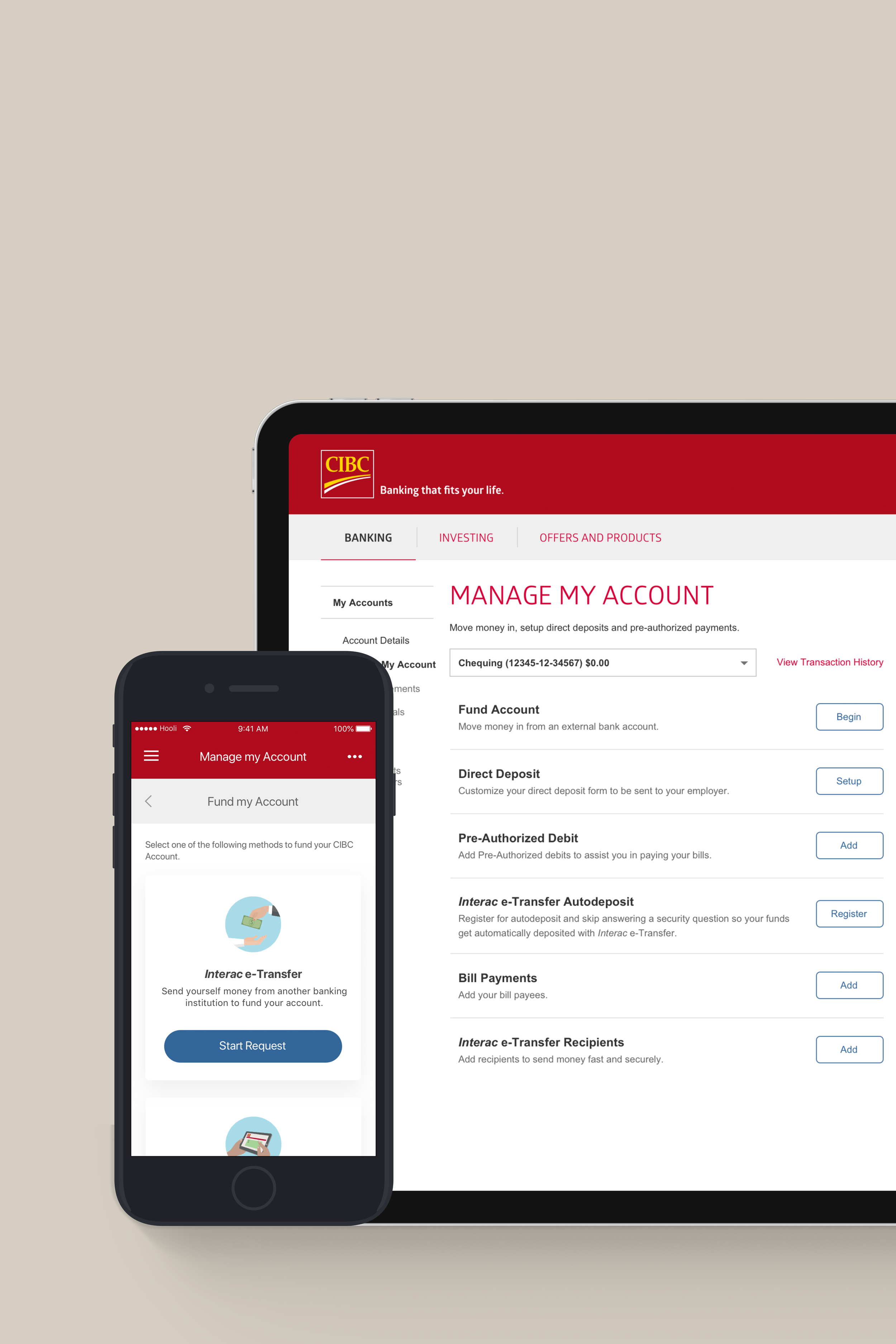

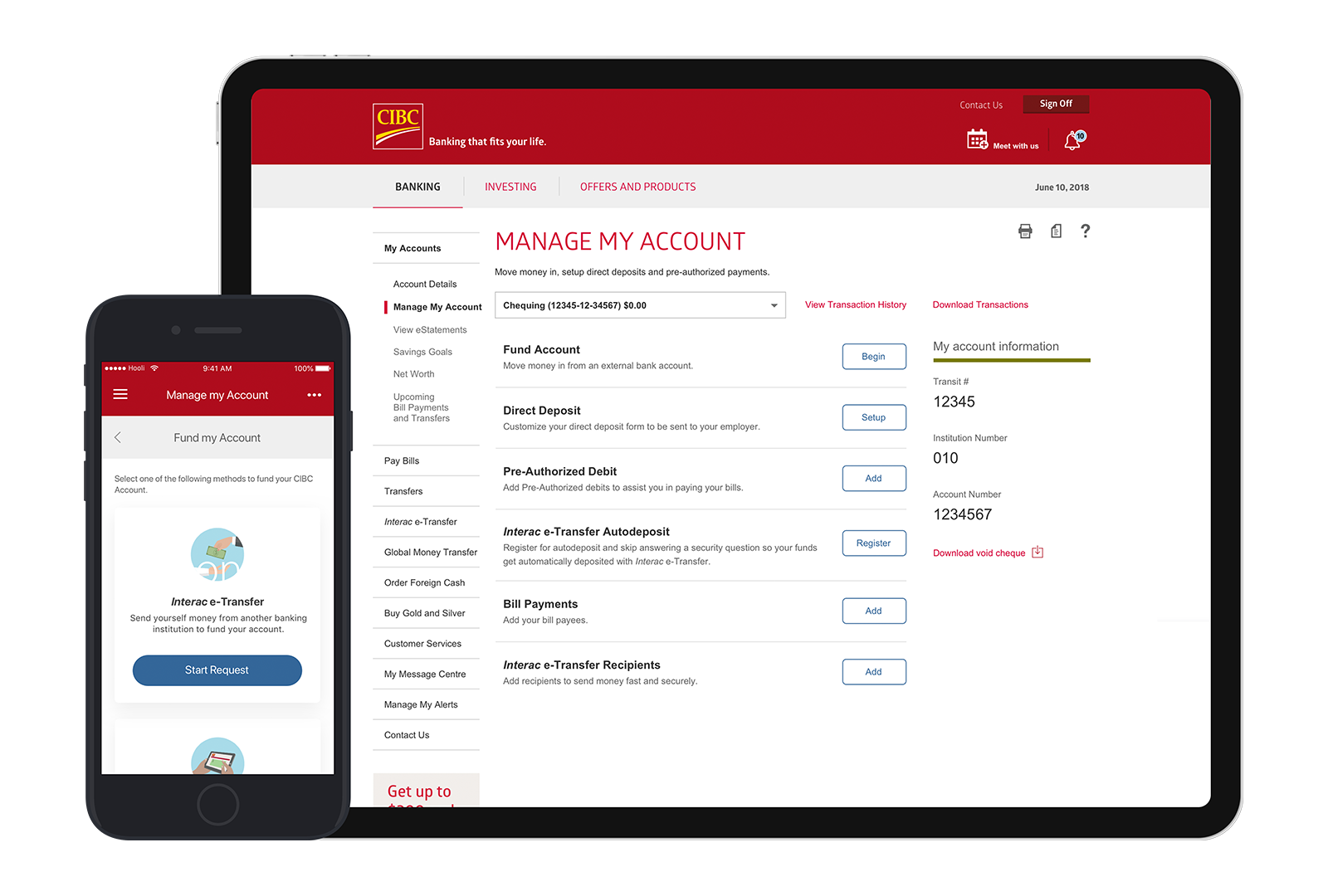

Desktop Experience

Centralized

Simple

Scalable

Mobile Experience

UX Research Methods

120 Canadian switchers participated in a usability test of the prototype

Over 6 hours of remote testing recordings with 17 users

13 unmoderated usability sessions of the prototype with prospective homebuyers

3 prototype iterations made based on user feedback

UX Research Findings

The prompted “Fund Account” button is effective in encouraging first action and provides the opportunity for new feature discovery

Primary switchers are mentally ready to move and benefit from information and support to ensure they are prepared to take action on required tasks

Account management hub received positive feedback for convenience of set-up options and ability to access functionality from a central location.

For Canadians, the e-transfer process is a familiar method of sending money between accounts. Nudging users to send e-transfers as a primary account funding option does not add complexity to the process

Simplifying the Direct Deposit form reduces barriers to completing + downloading the form and increases the chances that a depositor will accept the information

Final Recommendation

A centralized and simplified account switch hub brings together the fragmented journey associated with switching bank accounts. Clients will find value in an easy to locate switch hub that provides them with all the information necessary to move money into and out of their new account.

None of the other Canadian FI’s have a centralized switch hub. By centralizing the hub, CIBC is taking the first step to truly simplifying the switch process. CIBC can build upon this hub by integrating a vendor solution or building a solution to take away all the client effort and anxiety associated with switching accounts. This solution also addresses client irritants relating to being unable to locate certain online banking features or information as many of these items are located in the hub.

Project Outcomes

Funding for this experience was obtained fairly easily as there was minimal back end system impacts and it complimented a client onboarding service design initiative taking place in the bank at the time. Over the course of two quarters in 2018, I was brought on as a subject matter expert pertaining to this product feature in an ongoing project to consult and advise the core service design team on how this feature fits into the broader client onboarding journey.

The project was in the queue with CIBC’s delivery teams to be released sometime in 2020 but was evidently reshuffled to a later date due to a change in priorities during COVID-19.